The Necessary Clarification of Anti-Money Laundering Requirements: The Intervention of the Circular of June 8, 2021

The global impact of money laundering cannot be overstated, with the United Nations estimating a yearly cost between $800 billion and $2 trillion each year. In Belgium, the Financial Intelligence Processing Unit (CTIF) reported a 42% increase in suspicious transaction reports related to money laundering in 2021, according to their annual report released in May 2022. Considering this situation, financial institutions are more than ever under scrutiny and must comply with anti-money laundering laws, which are now an integral part of the European Union legislation.

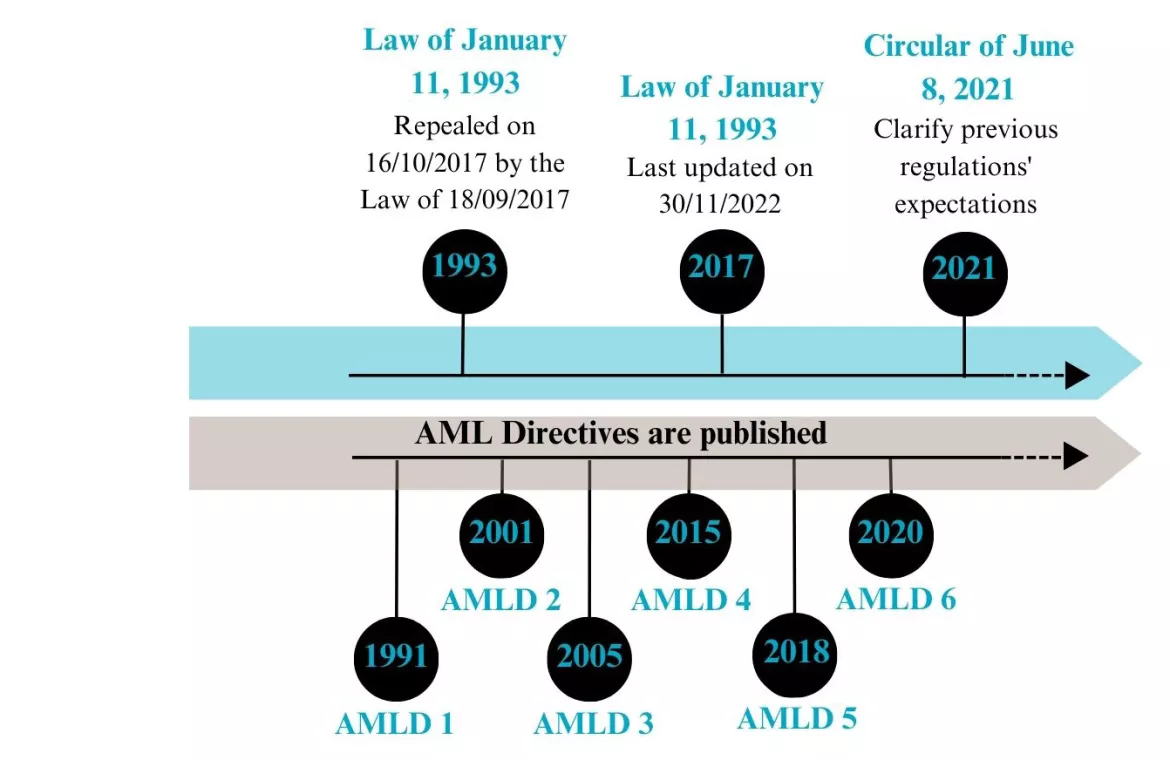

This translates into numerous directives and national transposition laws, such as, in Belgium:

Clarifications on the authorities’ expectations

Financial institutions, privileged tools for money laundering, are more closely scrutinized by authorities than ever before. Complying with anti-money laundering laws is no longer optional. However, these new regulations were often deemed insufficiently clear regarding their concrete implementation, which could generate uncertainties and disparities in their enforcement.

To address these issues, the National Bank of Belgium (NBB) published in June 2021 a circular clarifying the authorities’ expectations regarding the detection and declaration of suspicious operations and funds to the CTIF, as well as expectations when it comes to the verification of the origin of funds. This circular also addresses the sensitive issue of funds held by financial institutions following their repatriation from abroad. Financial institutions must now conduct an internal audit to examine a sample of approved cases of repatriation of funds from abroad. In this regard, a review of their tax legality must be carried out.

It is necessary for "a reasonable person to be convinced of the legality of the origin of the funds" and, if possible, this should be "corroborated by documents", all "proportionate to the money laundering risk".

If the examination reveals shortcomings, a remediation plan must be put in place. Finally, still for the purpose of clarification, the circular responds to numerous questions collectively raised by financial institutions.

It is crucial for those institutions to understand and comply with the rules that apply to them, as non-compliance can result in significant adverse consequences, including administrative sanctions, civil and criminal liability, and reputational risk. The clarifications provided by the NBB's circular of June 8, 2021 are essential to help financial institutions comply with anti-money laundering regulations.

Causes and stakes of the various practical approaches regarding the circular

Belgian financial institutions have welcomed the circular in different ways, with diverse internal policies. Some banks have adopted strict interpretations of the new regulations, while others have focused on taxpayer defense. This diversity of internal policies can be explained by factors such as the complexity of new regulations and divergent business considerations.

Financial institutions must decide on their policy when it comes to money laundering risks based on their risk aversion and commercial considerations. Some institutions adopt a zero-risk approach to their activities, strictly applying the clarifications of the circular with regards to repatriation of funds from abroad and detection of suspicious operations and funds. As a result, only proven and documented funds are accepted. Also, in case of doubts about repatriated funds, systematic declarations are made to the authorities, and consideration is given to offboarding clients with a high degree of risk. However, such zero-risk policies can be costly from a commercial point of view. In response, the NBB issued a new circular in February 2022, urging financial institutions to adjust the risk class of the concerned client and to report potential new suspicious transactions to the Financial Intelligence Processing Unit (CTIF) rather than offboarding suspicious clients. This is to prevent the funds from becoming untraceable for other financial institutions.

Other approaches, on the other hand, are more commercial and tend to consider the material impossibility of finding evidence or the amnesty promised by previous regularization schemes under the DLU Quater (Déclaration Libératoire Unique - Single Discharge Declaration). However, the authorities emphasise that imposed standards must be applied to avoid potential sanctions.

In any case, the clarifications provided by the circular of June 8, 2021 are essential to help financial institutions comply with anti-money laundering regulations. Spontaneous internal audits considering these clarifications are a valuable tool to ensure the lawfulness of repatriated funds and the effectiveness of internal processes. The feedback resulting from such audits allows for an adequate remediation project to be implemented, regardless of the approach taken by the financial institution in dealing with the risks.

The implementation of diverse internal policies can also be explained by various factors that may act as a hindrance for financial institutions, such as:

The stakes for financial institutions

Financial institutions that do not comply with anti-money laundering regulations are exposed to disciplinary sanctions, ranging from reprimands to partial or total withdrawal of accreditation. As per the Article 132 of the Belgian Law of September 18, 2017, institutions may face pecuniary sanctions of up to 10% of their annual turnover, and individual executives may be fined up to 5 million euros. These fines can be substantial, with large groups potentially facing several billion euros in penalties. For instance, in December 2022, Danske Bank, Denmark's largest bank, had to pay a fine of 470 million euros for failing to meet its obligations in the fight against money laundering. Similarly, in 2019, HSBC was fined 294.4 million euros in Belgium.

However, compliance with anti-money laundering requirements comes at a significant cost for Belgian financial institutions, which must allocate considerable resources to comply with new regulations and harmonize their internal policies. It should also be noted that some aspects of the obligations imposed on financial institutions are still unclear and will need to be clarified in the years to come, particularly through jurisprudence.

Belgian financial institutions must undertake numerous remediation projects and look-back procedures (retrospective analysis of past transactions) to harmonize anti-money laundering policies across the country. Belgian authorities encourage remediation projects to prevent sanctions, and banks are asked to invest in their compliance departments, as well as remediation and monitoring projects, to avoid potential sanctions.

Our support proposal

Financial institutions are facing an ever-changing regulatory landscape and it's crucial for them to have access to expert assistance to ensure they are compliant with relevant regulations. Avertim understands the challenges that financial institutions face and is committed to providing customized solutions that meet their unique needs.

Drawing on our extensive experience with anti-money laundering regulations and successful compliance projects, we offer a three-part approach that is tailored to each client's needs and overseen by our experts.

The approach includes:

At Avertim, we believe that our tailored approach, combined with our expertise, can help financial institutions meet compliance requirements while ensuring the sustainability of their business. Our experts are available to support you in your remediation and internal audit projects. Don't hesitate to contact us to learn more about how we can help ensure the security and compliance of your financial institution.